This will be the first in my series of Survival Workshops. They will be short articles about budgeting tools I use daily. Instead of a huge guide I plan to write small tips articles that I can share. Remember, the key to not being overwhelmed by finances is to break it down into small tasks.

Quick backstory

I tried scraps of paper, multiple notebooks, an attempt at an advanced Excel sheet. Nothing worked for me to get a grasp on my budget. Until I realized I had a calendar on my phone.

I use my Google Calendar for many reasons but the most obvious is; I can access it anywhere. On my personal (android) phone, my work (android) phone, and my browser. This means I don’t have to carry around a notebook, it’s always in my pocket.

How do I use the calendar to help me budget?

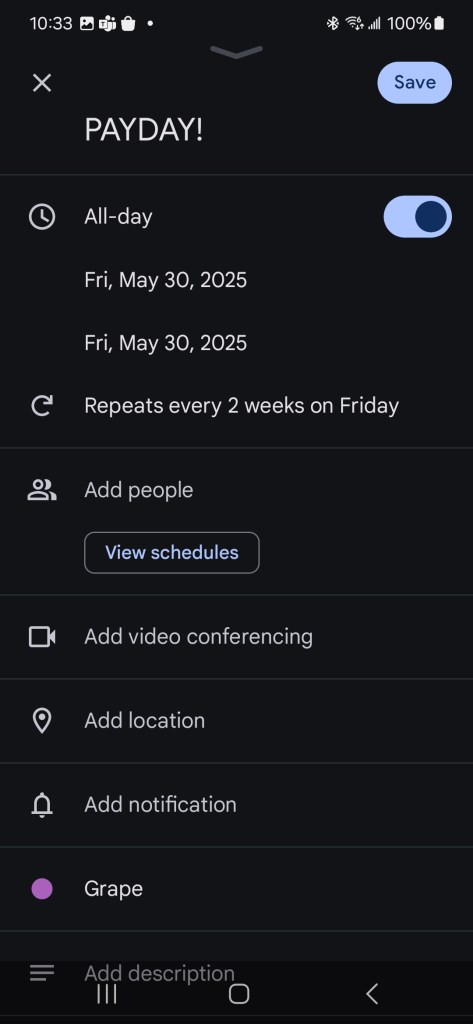

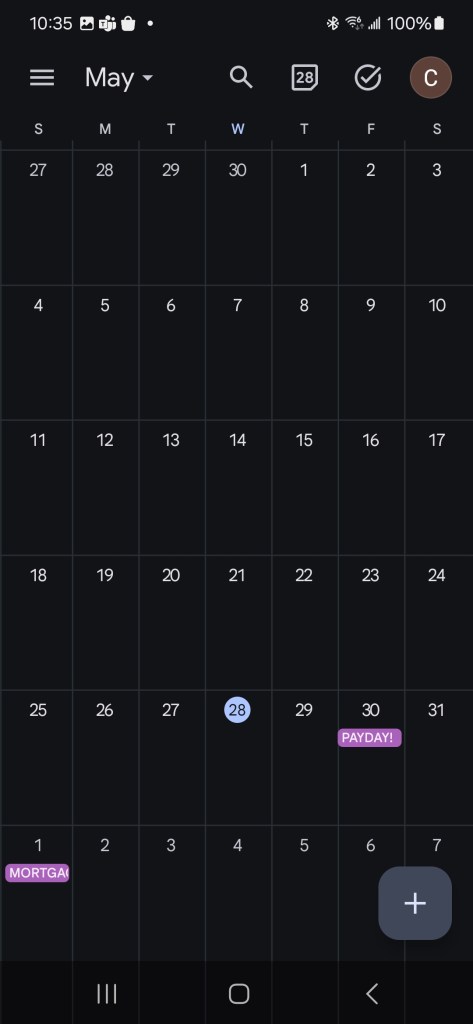

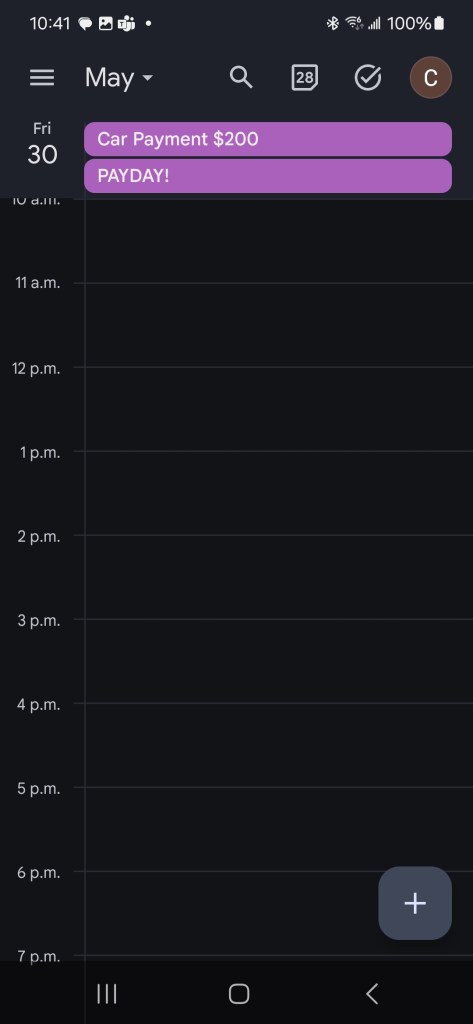

I sat down and wrote out all the bills I had coming up. The usual suspects: mortgage, power, heat, insurance, car payments, ect. I then entered them in my calendar and set them to repeat every month. Of course some bills are weekly, bi-weekly, ect but that’s easy to adjust. I then selected a colour I would use for all the entries, in this case purple. When I pay a bill I change the calendar entry to orange. Simple, right? Now I can quickly look at my calendar to see what has been paid and what’s coming up. This method requires very little maintenance. All you have to do is regularly check the amount you owe on the respective app and confirm the due date.

Visuals always help so let’s start with a blank calendar. I’m managing this all from my phone using Google Calendars:

With the above method in mind, keep adding your bills. Remember to setup the recurring event so they fill up your calendar. At first I only added my utilities, insurance, car payments. As I got better at budgeting I began adding smaller repeating costs like my daughter’s allowance (great reminder). Finally, for those annual bills like Water & Sewer and Property Taxes I began breaking down how much it would be per pay. This makes the cost much less scary and attainable. For example, I’m invoiced aprox $220 every 3-months for W&S so I broke it down into bi-weekly payments of $35. With this method I actually got ahead of the bill over the years and I’m usually an entire 3 months ahead.

Let’s stop here for today. Next we’ll look at how I update my calendar when bills are paid. Spoiler, we get to pick a new colour.

As always, thanks for reading.

You must be logged in to post a comment.